Calculating the Useful Life of a Fixed Asset

Content

Fixed asset on the other hand have longer periods as their useful life, assets like these are land, machines, facilities, buildings and equipment. The useful life of a fixed asset is important for accounting purpose because such asset depreciates, the longer their useful life is. One a fixed asset becomes depleted or is unable to generate income or serve the purpose for which it was bought, its useful life has ended. For example, cars have a five-year recovery period because the IRS anticipates that they’ll have a useful lifespan of five years. While the car will probably run longer than that, you’re not likely to continue using that car for business purposes after the first five years. Instead, a Reserve Bank lessee will recognize the lease payments in the Statement of Operations on a straight-line basis over the lease term and variable lease payments in the period in which the obligation for those payments is incurred. Depreciation is defined as the accounting process of allocating the cost of tangible assets to current expense in a systematic and rational manner in those periods expected to benefit from the use of the asset.

- Any business that seeks to be productively efficient can’t keep maintenance on the sidelines.

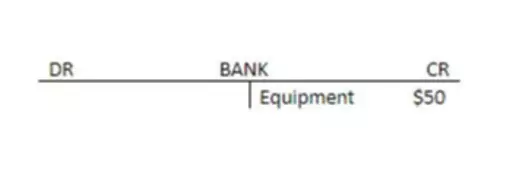

- You’ll also want to create a liability record for the loan and record the loan as a debt.

- Conversely, there are measures like preventive maintenance that businesses can take to prolong the useful life of important assets.

- 2When landscaping involves the roof of a secure wing and the roof of the space below plaza ground level, these landscape costs should be prorated between building and land improvements.

- Refrigerators, signs, office equipment and laboratory equipment all qualify.

Furniture includes office equipment, desks, cupboards and conference tables. Fixtures include built-in items that you can’t easily remove, such as fireplaces.

Advantages & Disadvantages of Straight-Line Depreciation

The depreciation is calculated using the diminishing balance method as presented below. Note that depreciation rate is calculated using the goal seek function. You can calculate depreciation by dividing the costs of an asset by its estimated useful life. In summary, assigning useful lives to fixed assets takes some judgment on the part of management. Useful lives may vary by each asset, each category of asset, and from company to company.

The total depreciable amount for the life of the asset is $180,000 ($200,000 – $20,000). For example, a manufacturing company purchases a machine on Dec. 1, 2019 for $56,000. If a company buys an asset for $5000 and expects to sell it for $1000 in three years, it can then fixed assets useful life depreciate $4000. At the end of three years, the company expects to sell the asset for $1000. This method writes off more of the cost in the early years and less in the later years. The convertability of an asset refers to how easily you can convert it into cash.

Check Manufacturer Specifications

The agency’s Publication 946 lists the estimated useful life for various assets depending on industry and application. The estimates can serve as a baseline to determine https://online-accounting.net/ the metric for similar assets. Climate-related risks may impact the estimated useful lives of assets as well as the depreciation or amortisation method.

Business owners know that maintaining complete and up-to-date fixed-asset records isn’t easy. What’s more, if you are preparing for any audit, fixed-asset management accounting can be quite daunting. That’s why it’s essential to have the right tools to help you monitor fixed assets throughout their useful lives. NetSuite’s financial management solution provides real-time visibility into all of your company’s fixed assets and expedites financial transactions. A fixed-asset accountant is usually a certified public accountant who specializes in the correct accounting of a company’s fixed assets. Fixed-asset accountants often work with other accounting roles to calculate asset depreciation.

What Is a Fixed-Asset Accountant?

This account should be charged for all costs of a new building, the purchase price of a building to be held for future use pending renovation, and all renovation and improvement costs. Receipts from the sale for such items as scrap or recoveries of building costs for such items as change orders and insurance should be deducted from the amount of the project to be capitalized. Use clearing accounts when you cannot immediately post payments to a permanent account. For example, if you are furnishing a new building for a client, you may place costs and payments in a clearing account until the work is complete. If checks must clear and you have the cash to deposit in the bank , you may add the amounts to a clearing account. Clearing accounts provide temporary holding places for cash totals.

- In this phase, you eliminate the assets from the accounting records.

- When conducting floor renovations, Reserve Banks should look to their historical renovation trends to determine if the renovation should be capitalized and given a distinct useful life.

- In some cases, other real estate will include buildings with tenants.

- Climate-related risks may have a substantive financial or strategic impact on a company’s business, affecting the useful lives and residual values of its assets.

Depreciation of PP&E is governed by IAS 16, whereas amortisation of intangible assets is set out in IAS 38. Requirements of these two standards mostly overlap with a few notable exceptions that are discussed specifically where applicable. Otherwise, all of the discussion on this page applies equally to property, plant and equipment and to intangible assets. The units-of-production depreciation method depreciates assets based on the total number of hours used or the total number of units to be produced by using the asset, over its useful life. But implementing a well-planned maintenance strategy can help prolong the investment’s useful life. Major asset failures also should be factored in when estimating the figure. Additionally, as businesses scale or change their operations, assets may require upgrades or be rendered obsolete.

When to Record Software and Associated Costs as Fixed Assets

Once you have your depreciation value, you’ll need to store that information. It doesn’t make sense to store it apart from all of your other asset information, so find a way to record it in your asset database. There are certain conditions that can cause adjustments to be made to the measurement of the useful life of an asset. For instance, if a machine becomes obsolete in no time due to the development of certain technologies that were not in the machine before, the useful life estimate of such assets will be adjusted. The adjustment is due to the advent of the new technology because without the introduction of the new technology, the machine might still have more useful years. Businesses can use some forward-looking measures to extend the effective life of their assets and save money in the long run.

Sun Life to acquire a majority stake in Advisors Asset Management – PR Newswire

Sun Life to acquire a majority stake in Advisors Asset Management.View Full Coverage on Google News

Posted: Thu, 01 Sep 2022 21:26:00 GMT [source]