What are T-Accounts Example, Debits and Credits of T-Accounts, Rules

Content

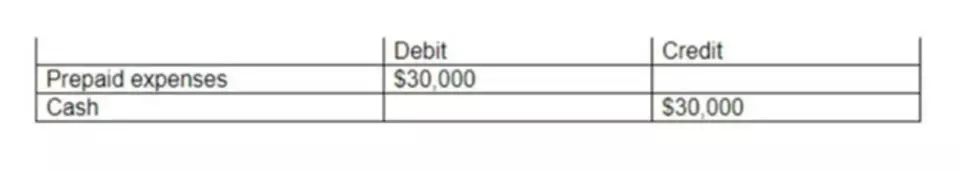

The record is placed on the credit side of the

Service Revenue T-account underneath the January 17 record. This is posted

to the Cash T-account on the credit side beneath the January 18

transaction. This is placed

on the debit side of the Salaries Expense T-account. Notice that for this entry, the rules for recording journal

entries have been followed. Note that this example has only one debit account and one credit

account, which is considered a simple entry.

Making the decision to study can be a big step, which is why you’ll want a trusted University. We’ve pioneered distance learning for over 50 years, bringing university to you wherever you are so you can fit study around your life. Before you can begin to use a T-account, you have to understand some basic accounting terms.

T accounts

Another example is a liability account, such as Accounts

Payable, which increases on the credit side and decreases on the

debit side. If there were a $4,000 credit and a $2,500 debit, the

difference between the two is $1,500. The credit is the larger of

the two sides ($4,000 on the credit side as opposed to $2,500 on

the debit side), so the Accounts Payable account has a credit

balance of $1,500. When calculating balances in ledger accounts, one must take into

consideration which side of the account increases and which side

decreases.

T-accounts help to visualise the process making it clear what is occurring with each transaction. So, to show this, T-accounts are usually displayed in pairs to show the impact of a complete business transaction in your accounts. A T-account is a visual way of displaying the transactions occurring within a single account.

Example 3 – Paying rent

It takes the guesswork out of managing spending across locations and gives accounting professionals granular insight into every dollar flowing into and out of the organization. Go a level deeper with us and investigate what are t accounts the potential impacts of climate change on investments like your retirement account. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

For example, if you debit an account, you must also credit another account to ensure the books are in balance. Debits and Credits are simply accounting terminologies that can be traced back hundreds of years, which are still used in today’s double-entry accounting system. When most people hear the term debits and credits, they think of debit cards and credit cards.

How do you make a T account?

T accounts are also used by even experienced accountants to clarify the more complex transactions. In Section 2.3 we recorded the consequences of these transactions in a balance sheet for Edgar Edwards Enterprises dated 6/7/20X2. As there were only six transactions, it was probably not too difficult.

- Some accounts have a debit-side balance, while others have a credit-side balance.

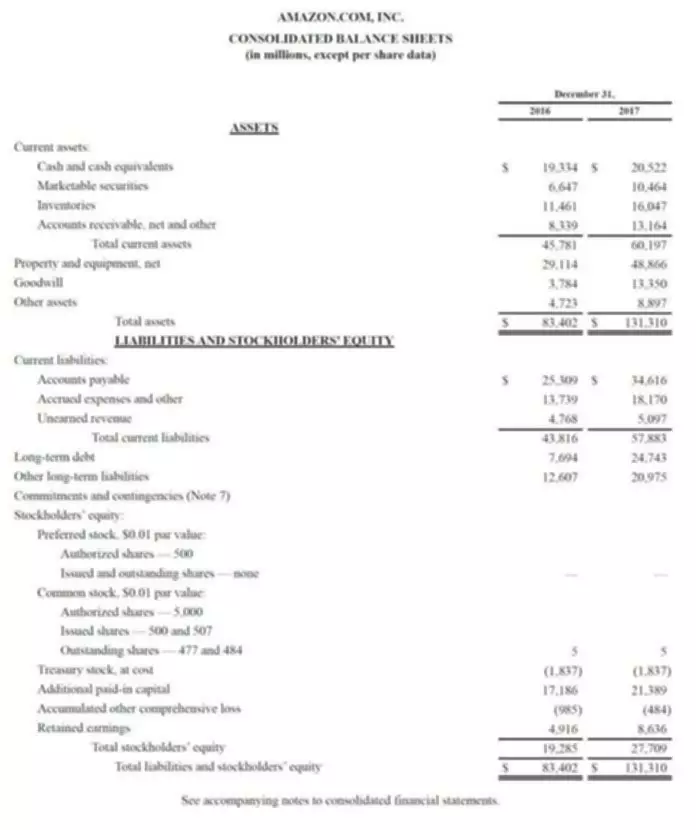

- As of October 1, 2017,

Starbucks had a total of

$1,288,500,000 in stored value card liability. - This informs that you have a balanced account in your general ledger or that an error has occurred in the accounting process.

- A trial balance summary is a report that summarizes the account balances in a company’s general ledger.

- It provides the management with useful information such as the ending balances of each account which they can then use for a variety of budgeting or financial purposes.

- I will use my coffee shop to represent a business throughout these examples.

It really shows how useful it is to try to draw out transactions in T-accounts before they are committed to the company records. This prepaid £6000 represents an asset because my landlord owes me 3 months usage of his property since I have paid rent in advance. As I’ve received the coffee machine, I’ve gained £700 worth of fixed assets (this account has been debited). They are a useful tool for both newcomers to accounting and veteran accountants alike to quickly map out the correct way to record a transaction.

Now add up the total of all the individual entries on this side and put it as a total below all the other amounts on this side.

However, many enterprises have to record hundreds of transactions per day. Having individual T-accounts within the nominal ledger makes it much easier to collect the information from many different types of transactions. The next section will explain what is done with the balances in each of these accounts. T-accounts can also impact balance sheet accounts such as assets as well as income statement accounts such as expenses. The ingredients for the cup of coffee are recorded as inventory (asset account). My inventory is reduced each time I sell a coffee so I need to credit the inventory account by 50p, reducing its value.

- Grocery stores of all sizes must purchase product and track

inventory. - You should now be familiar with the rules of double-entry bookkeeping that are crucial for both financial and management accounting.

- Colfax Market is a small

corner grocery store that carries a variety of staple items such as

meat, milk, eggs, bread, and so on. - Accounts Receivable has a credit of $5,500 (from the

Jan. 10 transaction). - The next transaction figure of $300 is added on the credit

side. - The major components of the balance sheet—assets, liabilities and shareholders’ equity (SE)—can be reflected in a T-account after any financial transaction occurs.

Capital, and each type of asset and liability, has its own T-account. These T-accounts are recorded in the general ledger (also known as the nominal ledger). Figure 1 below shows the general ledger and the three categories of T-accounts therein that we have discussed so far. One problem with T-accounts is that they can be easily manipulated to show a desired result. For example, if you want to increase the balance of an account, you could simply credit the account without recording a corresponding debit. This would create a false positive in the accounting records.Another problem with T-accounts is that they do not show the effect of double-entry bookkeeping.

Common T-Account Questions

T-accounts can be particularly useful for figuring out complicated or closing entries, allowing you to visualize the impact the entries will have on your accounts. I now have three month’s worth of rent paid for, so my prepayments (prepaid rent) account is debited £6000. Rent https://www.bookstime.com/articles/certified-bookkeeper is classed as an operating cost as it’s a standard cost required to run my business. Operating costs are a type of expense so it is debited by £2000. This visual guide helps you ensure figures are being posted in the correct way, potentially reducing data entry errors.

CD vs. Money Market Accounts: Understanding the Differences – GOBankingRates

CD vs. Money Market Accounts: Understanding the Differences.

Posted: Tue, 30 May 2023 16:30:14 GMT [source]

Another key element to understanding the general ledger, and the

third step in the accounting cycle, is how to calculate balances in

ledger accounts. You can see at the top is the name of the account “Cash,” as

well as the assigned account number “101.” Remember, all asset

accounts will start with the number 1. The date of each transaction

related to this account is included, a possible description of the

transaction, and a reference number if available.

A T-account is a visual depiction of what a general ledger account looks like. It also makes it quite easy to keep track of all the additions or deductions in an account. The debit side is on the left of the t-account and the credit side is on the right. A bookkeeper can quickly spot an error if there is one and immediately fix it with the help of this visualization.

The record is placed on the credit side of

the Accounts Receivable T-account across from the January 10

record. This is posted

to the Cash T-account on the credit side beneath the January 14

transaction. Accounts Payable has a debit of $3,500 (payment in

full for the Jan. 5 purchase). You notice there is already a credit

in Accounts Payable, and the new record is placed directly across

from the January 5 record. In the final section of this week we will go back to our accounting equation to show that the balances from the trial balance can be used to prepare the balance sheet.