Cost of Goods Sold – Total price paid for products sold during the accounting period, plus transportation costs to acquire the goods. Service and professional companies will have no costs of goods sold, whereas, manufacturers will have detailed statements. A Profit and Loss (P & L) statement measures a company’s sales and expenses during a specified period of time. The function of a P & L statement is to total all sources of revenue and subtract all expenses related to the revenue.

- Net Operating Profit – Gross margin minus selling and administrative expense.

- This can also be called the cost of services and is often referred to as COGS.

- Non-operating expenses are the expenses that are incurred by your business but are not related to your core business operations.

- The single-step income statement is the simplest income statement format, calculating revenue totals and subtracting expenses to arrive at net income.

- Thus, you need to add all the operating expenses specified in the trial balance report and enter the same expenses in the income statement as selling and administration expenses.

- Values from the tax return, however, may not accurately measure the economic performance of the farm.

The other important documents are the balance sheet, the cash flow statement and the statement of shareholder’s equity. An income statement is a financial statement that shows you the company’s income and expenditures. It also shows whether a company is making profit or loss for a given period. The income statement, along with balance sheet and cash flow statement, Income Statement Format, Components, and Purpose helps you understand the financial health of your business. An income statement is one of the three major financial statements that reports a company’s financial performance over a specific accounting period. The last item disclosed as part of the income statement before the earnings per share data can be the cumulative effect of accounting changes.

The balance sheet and income statements complement one another in painting a clear picture of a company’s financial position and prospects, so they have similarities. RevenueIn USD millionsTotal Revenue214,456,000Cost of goods sold12,870,000Gross profit201,586,000Further, we can also calculate operating profit which is, operating expenses subtracted from the gross profit figure. This tells us what is the company’s profit before its interest and tax liabilities are accounted for. Some small business owners may not think they need to worry about the income statement; after all, they know how much cash they have in the bank and how much is paid out. But for any business owner who wants to identify expenses to cut or find new markets to enter, the income statement is invaluable. It can also help you stay on top ofcash flow, which is the lifeblood of all businesses. The income statement is one of three financial statements that are important to businesses of all sizes.

A single-step income statement is one of the formats for profit & loss statements that involves just one step to determine the net income of your business. This step involves subtracting expenses and losses from incomes and gains. Calculate operating income, which is income your business entity is able to earn from normal business operations. This is calculated by subtracting operating expenses from the gross profit. The multi-step income statement categorizes revenues, gains, expenses, and losses into operating and non-operating items.

Components of comprehensive income may not be presented in the statement of changes in equity. After revision to IAS 1 in 2003, the Standard is now using profit or loss for the year rather than net profit or loss or net income as the descriptive term for the bottom line of the income statement. Shifting business location, stopping production temporarily, or changes due to technological improvement do not qualify as discontinued operations. Other expenses or losses – expenses or losses not related to primary business operations, (e.g., foreign exchange loss). When a company sells or scraps a long-term asset that had been used in the business, the asset’s cost and accumulated depreciation must be removed from the company’s accounts.

Assessing The Cost Of Goods Sold

As you can see, while Nike uses a variety of terms to explain what their expenses are and name each line item as clearly as possible, the take away is still the bottom line, their net income. For ease of reading, it’s better to group things together into categories of expenses—for example, office supplies, or advertising costs. Now that you know the overall definition of an income statement, let’s take a deeper look. In response to an increase in the use of the earnings per share figure and to a large variety of definitions, computations, and disclosure formats, the APB issued Opinion 15. A survey reported that only 53 out of 600 of the surveyed companies disclosed this type of item. The fact that the survey showed 204 disclosures of extraordinary items in 2018 illustrates the restrictive impact of APBO 30 on practice. In addition to knowing whether discontinuation has taken place, the accountant also needs to know the effective date of the discontinuation to report its effects in the appropriate period.

- Non-operating ExpensesNon operating expenses are those payments which have no relation with the principal business activities.

- Read the income statement from top to bottom, the line items are placed in logical order.

- The following are the steps to prepare an income statement for your business.

- All non-owner changes in equity (i.e., comprehensive income) shall be presented either in the statement of comprehensive income or in a separate income statement and a statement of comprehensive income.

- Expenses represent the gross decreases in owners’ equity caused by operating events.

Financial StatementFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . It is the same as the profit and loss account that reflects the final income of a firm.

Expenses And Losses On The Income Statement

Other expenses may be incurred in one year but not paid until the following year or later, such as farm taxes due, and other accounts payable. Record accounts payable so that products or services that have been purchased but not paid for are counted. However, do not include any items that already appear under cash expenses.

This is fairly straightforward—here you would include any interest payments that the company is making on its loans. Where appropriate, the firm should provide a footnote to explain the nature of the gain or loss. If phaseout is completed in the same year as the decision date, the discontinuation gain/loss is the sum of the two components. If it is not completed, the rules become more complex, as described in the below example.

- A Profit and Loss (P & L) statement measures a company’s sales and expenses during a specified period of time.

- Studying a company’s income statement can help managers, investors, creditors, and analysts to form an understanding of the business’s performance and profitability.

- Income statements can be prepared monthly, quarterly, or annually, depending on your reporting needs.

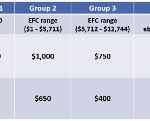

- If the application of a uniform margin is inappropriate, product classes could be developed based on gross margins.

- For example, income statements don’t reflect missed business opportunities or positive or negative societal impacts.

- But if you make a lot of mistakes, it could paint an inaccurate picture of how your business is performing – which is why it’s important to follow these three best practices when creating your income statement.

This guide will give you a comprehensive overview of both financial statements. For example, gross profit is a figure which can be arrived at by deducting costs related to making and selling of the company goods and services from the revenue or sales figure. The gross profit helps us understand how well the company is using the resources at hand and producing goods or services that customers are willing to pay for. Income statements are among the most important financial statements small business owners should maintain. But if you make a lot of mistakes, it could paint an inaccurate picture of how your business is performing – which is why it’s important to follow these three best practices when creating your income statement.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Discover the products that 31,000+ customers depend on to fuel their growth.

Choosing An Accounting Period

Our expert bookkeepers here at Bench have built an income statement template in Excel that you can use to assess the financial health of your business and turn your financial information into an income statement. If your business owes someone money, it probably has to make monthly interest payments. Your interest expenses are the total interest payments your business made to its creditors for the period covered by the income statement. When a business owner makes an income statement for internal use only, they’ll sometimes refer to it as a “profit and loss statement” (or P&L). The statement format shows “costs and expenses” incurred during the year. These costs can directly or indirectly affect the revenue of the company.

An amount allowed for trade discounts recognizes the discrepancy between a standard or „catalog“ price and the actual price paid by customers. An allowance for trade discounts decreases total sales to reflect prices actually paid. Use one of our templates to list the sales, expenses, and other gains or losses in the correct format. At the bottom of the statement, compute the net income for the company. In both income statement formats, revenues are always presented before expenses. If the company reports profits worth $10,000 during a period, and there are no drawings or dividends, that amount is added to the shareholder’s equity in the balance sheet.

Whats Included In A Balance Sheet?

Not only the company management but also other stakeholders like potential investors, shareholders, banks, creditors, tax authorities, suppliers, etc. have one or the other use for the income statement. Operating income is also referred to as EBITDA, or earnings before interest, taxes, depreciation, and amortization. You calculate your operating income by subtracting your total operating expenses from your gross margin. The ability to plan and forecast is made much easier with income statements. Being able to analyze the trends in pricing and sales over an extended period can improve your ability to predict how your business will fare in the future. The longer you have an income statement, and the more detailed it is, the easier it will be to spot trends and analyze gross margin performance.

- Accountants use some judgement when organizing these items, using breakdowns that most naturally reflects how the business works.

- Sales are reported on the income statement when the ownership of the goods passes from the company to the customer.

- On the other hand, the Income Statement is used by such stakeholders to see if the company is making enough profits to pay off its debts.

- The second reason to prepare a P & L statement is because it is required by the IRS.

- If you purchase products for resale, your cost of goods sold is the cost of purchasing those products.

Earnings per share can be calculated by dividing the company’s profits by shares of common stock. Trial balance reports are internal documents that list the end balance of each account in the general ledger for a specific reporting period. Creating balance sheets is a crucial https://accountingcoaching.online/ part of creating an income statement, as it’s how a company gathers data for their account balances. It will give you all the end balance figures you need to create an income statement. The purpose of income statements is to show the profitability of your business.

Purpose Of Income Statements

The gross amount of revenue is stated in the first line item of the income statement, after which deductions are listed for sales returns and allowances. These deductions are subtracted from the revenue figure to derive a net revenue number. Some organizations prefer to net these two line items together, so that only a net revenue figure is presented. Another option is for a business to present a different line item for each revenue source, such as one line for goods sold and another line for services sold.

A company which reports any of the irregular items must also report EPS for these items either in the statement or in the notes. Adding to income from operations is the difference of other revenues and other expenses.

Your Farm Income Statement

It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. An income statement indicates how the revenues are transformed into the net income or net profit. Subtract the cost of goods sold total from the revenue total on your income statement. This calculation will give you the gross margin, or the gross amount earned from the sale of your goods and services. To create an income statement for your business, you’ll need to print out a standard trial balance report. You can easily generate the trial balance through your cloud-based accounting software. Common size income statements include an additional column of data summarizing each line item as a percentage of your total revenue.

Differences between IFRS and US GAAP would affect the interpretation of the following sample income statements. Income tax expense – sum of the amount of tax payable to tax authorities in the current reporting period (current tax liabilities/ tax payable) and the amount of deferred tax liabilities . Financial modelling can help companies forecast future performance or analyze the impact of anticipated changes to the business, such as making an acquisition or discontinuing a product line. The data on an income statement is analyzed by both internal and external users. Large organizations may have an entire department dedicated to financial planning and analysis that constantly scrutinizes the results of operations. Find the expenses that roll into COGS, such as raw materials, direct labor and freight-in. COGS is the first expense section listed on the income statement, reading top to bottom.

Through the income statement, the reader can comprehend how profitable the business is and what are the various business activities that the company has undertaken. We are also able to determine the amount of profit or loss that was generated over the course of a particular period of time. If one was to put together income statements from a consecutive number of years, a trend analysis could be done as well, to determine the change in revenue and expense items over time. Used by businesses that sell tangible goods or have more than one line of business, the multistep income statement, as its name implies, uses multiple steps instead of one. With this type of income statement, the operating revenue and operating expenses are separated from the nonoperating revenue and nonoperating costs, losses and gains.

Marketing, Advertising, And Promotional Expenses

This is because things such as tax deductions vary from year to year and can impact business earnings, thus not giving a true and fair view of the profitability of your business. Financial analysts make use of operating income rather than net income to measure the profitability of your business. You must remember that to calculate gross profit, only variable costs are taken into consideration, meaning the costs that change with the change in the level of output. The following are the steps to prepare an income statement for your business. We provide third-party links as a convenience and for informational purposes only.

As a reminder, a common method of formatting such data is to color any hard-coded input in blue while coloring calculated data or linking data in black. There is no gross profit subtotal, as the cost of sales is grouped with all other expenses, which include fulfillment, marketing, technology, content, general and administration (G&A), and other expenses. Also called other income, gains indicate the net money made from other activities, like the sale of long-term assets. These include the net income realized from one-time non-business activities, like a company selling its old transportation van, unused land, or a subsidiary company. Preparing an income statement is one of the basic responsibilities of the accounting function. Accounting is the process of recording and disclosing the financial information for a company so that operating results can be known and comparisons between different years and different companies can be made.

Determine Cost Of Goods Sold

It records revenues, gains, expenses, and losses to evaluate net income. Also known as pretax income, this item is a measure of profitability that analysts pay attention to when reviewing a company’s financial statements.

Determining the manufacturer’s cost of goods is complicated by the need to allocate the manufacturing overhead costs. A retailer’s cost of sales includes the cost paid to the supplier plus any other costs to get the items into the warehouse and ready for sale. For example, if a retailer purchases a product for $300 and pays an additional $20 of shipping costs to get the item into its warehouse, the cost of the product is $320. Bottom line the income statement is a critical tool for communicating a company’s performance to people outside and within the company. The data in income statements can be analyzed for many different purposes, including identifying trends, developing forecasts and comparing the company with competitors. Net income, calculated as total revenue minus total expenses, is reported at the end of the statement. “Single step” refers to the fact that only a single subtraction is needed to calculate net income.