Gross Margin vs Contribution Margin: What’s the Difference?

Content

- How Important is Contribution Margin in Business?

- What are variable costs?

- How to Use Text Ads to Boost Google Shopping Sales

- The Evolution of Cost-Volume-Profit Relationships

- Gross Margin vs. Contribution Margin: What’s the Difference?

- How To Calculate Contribution Margin as a Percentage or Ratio

- How do you calculate it?

In this case, you would need to have some understanding of what expense line items contribute solely to fixed costs. This can be somewhat of a challenge and requires that some assumptions are made on what might be considered fixed versus variable.

Paytm Q2 hits & misses: Focus on profitability intact, improvement in contribution margin tepid – Business Today

Paytm Q2 hits & misses: Focus on profitability intact, improvement in contribution margin tepid.

Posted: Wed, 09 Nov 2022 08:00:00 GMT [source]

Company XYB manufactures T-shirts and made total sales of 3,000 units at a price of $30. Calculate the contribution margin and interpret it if the total variable costs that the company incurred are $95,000. Contribution margin is the revenue that is generated beyond what is necessary to cover the variable costs of production, such as materials and non-salaried labor costs. It can also include the firm’s profit if the amount exceeds the total amount of the fixed costs. An essential concept when dealing with contribution margins is whether a cost is fixed or variable.

How Important is Contribution Margin in Business?

It can change over time as the sales price and variable costs fluctuate. For that reason, a product that was once a great fit for your portfolio may very well need to be eliminated if the numbers turn down. The grilled cheese sells for $8 with $2 in variable costs for a $6, or 75%, contribution margin. The low variable cost with the grilled cheese is due to Laina using reliably sourced artisan bread and cheese, so this sandwich is mostly fixed costs. It’s important how you break down and categorize expenses from your income statement into variable and fixed cost buckets. Not all expenses will cleanly fall into either bucket, so it’s critical that your accounting and financial analysts are consistent with how they classify expenses.

- A consulting business with a traditional office space may consider the water bill, for example, a fixed cost.

- You can calculate the contribution margin for individual products, called unit contribution margin, or for the entire business, which is called total or gross contribution margin.

- It is important to assess the contribution margin for breakeven or target income analysis.

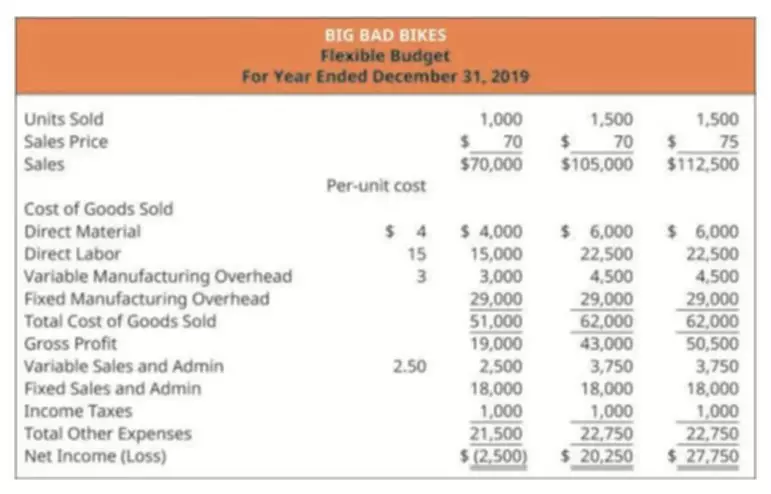

- Companies can also consider taxes when performing a CVP analysis to project both pre-tax and post-tax profit, however that is beyond the scope of this introductory course on accounting.

- So, working with fixed costs per unit can be very problematic because of the big uncertainty regarding the number.

The main drawback of the contribution margin formula is that it leaves business owners with a dollar amount. Luckily, there are a few other ways to look at contribution margin that can help business owners look at their overall contribution margin and product-specific margins with more objectivity. Your contribution margins can also be assessed on a product-specific level. So if you produce a wide variety of products, calculating the contribution margin for each product will help you understand which ones are your top performers and which ones you should consider dropping. Remember that your contribution margin income statement will reflect the same figure for net income as your regular income statement . A contribution margin income statement, however, does not meet the standards set forth by the Generally Accepted Accounting Principles.

What are variable costs?

A mixture of increasing the selling price per unit and lowering the variable cost per unit. By retaining more customers, you are ensuring sales in the future to help meet those cost demands. Creating a loyal customer base also means that if you happen to raise your prices, they will be more likely to stick around despite the increase. Additionally, by relying on less expensive retention channels like email and SMS rather than acquisition, your CPOs will be lower, and your contribution margins will be higher. From there, you can make changes to improve your variable expenses or revisit your product costs/pricing. Some examples of changes to make include reducing labor and materials costs, increasing MOQs, optimizing the production process to reduce utility costs, and cutting down on commissions or transaction fees.

- But a dog grooming business that uses water to provide their service would almost certainly consider the water bill a variable cost.

- When taking a look at how your business is doing financially, it’s tempting to focus all your attention on the “bottom line.” In other words, are you turning a profit or not?

- The benefit of ratios is that they take dollar amounts out of the picture, allowing you to compare product margins side by side—without taking sales volume into account.

- If they send nine to sixteen students, the fixed cost would be $400 because they will need two vans.

The contribution per unit of the company’s only product was $6 consisting of revenues of $10 minus the variable expenses of $4. The contribution margin ratio for the product was also 60% (contribution margin of $6 divided by the selling price of $10). Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold. The contribution margin is widely used by managers and analysts to assess the profitability of different business lines and different departments.

How to Use Text Ads to Boost Google Shopping Sales

In general, a higher contribution margin is better as this means more money is available to pay for fixed expenses. Although the company has less residual profit per unit after all variable costs are incurred, these types of companies may have little to no fixed costs and maybe keep all profit at this point. Company ABZ manufactures https://www.bookstime.com/ three types of candies , which use almost the same raw materials in different quantities and the same machinery. Company ABZ has employees that are trained to produce all types of candies equally. In the last year, the company made $220,000, $310,000, and $180,000 in total sales of candy A, candy B, and candy C, respectively.

Where C is the contribution margin, R is the total revenue, and V represents variable costs. For example, assume that the students are going to lease vans from their university’s motor pool to drive to what is contribution margin their conference. If they send one to eight participants, the fixed cost for the van would be $200. If they send nine to sixteen students, the fixed cost would be $400 because they will need two vans.

The Evolution of Cost-Volume-Profit Relationships

A high contribution margin indicates that a company tends to bring in more money than it spends. Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. The contribution margin ratio for the company was 60% (contribution margin of $480,000 divided by revenues of $800,000). The contribution margin tells us how much of the revenues will be available for the fixed expenses and net income.

How Do You Calculate Contribution Margin?

Contribution margin is calculated as Revenue – Variable Costs. The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue.

This example highlights how businesses can tweak and package products to influence sales while still maximizing contribution margins. Because of the revenue recognition principle, contribution margin applies equally whether your business sells directly to customers or is sold through partners. Once you have calculated the contribution margin it can be used for a variety of applications.

Gross Margin vs. Contribution Margin: What’s the Difference?

Whether you have a great month or a terrible month, you’ll still need to pay all your software subscriptions, rent, and phone bills. Variable costs also live on the income statement, but they’re not as easy as net sales to find. Instead, they’re usually listed as line items within cost of goods sold, right alongside fixed costs.