Outsource Bookkeeping Services

Content

One of the easiest ways to secure an experienced, certified, professional bookkeeping service is to outsource to a complete bookkeeping service comapny. And after utilizing their services, you may just find that your company couldn’t afford to not outsource these functions. Many times, switching to an online bookkeeping service is a beneficial move for a company. We take a holistic approach because we want each one of our clients to feel like our only client.

But there are now some very interesting professional bookkeeper models that allow you to hire a consultant without taking a huge financial risk. No more incorrect estimations, get exact calculations. We accommodate accounts from micro-businesses to corporate clients. Please contact us for a discounted rate for price plans outside the following packages. One of the services we provide is an elderly or senior bill paying service.

Need-specific Software

They enter both https://www.bookstime.com/ and credit dealings into the appropriate “book,” which is often online (petty cash, suppliers, customers, etc.) —along with the general ledger. Then they create financial reports, such as income statements and balance sheets, from that information.

- If you’re devoted to a particular type of software, you’ll want to find a bookkeeper that is well-versed in using it.

- Pilot is a finance, accounting, and tax services firm built for VC backed startups.

- You’ll also have to pay for a QuickBooks Online subscription on top of that.

- This process can begin from bringing in a bag of invoices and bank statements or granting me access to a fully reconciled cloud hosted computerised book-keeping data set, or anywhere in between.

- We’ve been with Sleek since the very beginning of our business.

There are several online bookkeeping services available, but we’ve identified the best in terms of pricing, features, and quality of service. You give your business so much in order to grow and succeed. You give it your time, expertise, and ideas, you market your products and services and hire qualified employees, you design benefits packages, maintain insurance, and have a dedicated space. Having visibility of accurate financial statements also will set a company up for future growth. Plenty of people believe bookkeepers’ work is primarily centered on data entry and some even mistakenly believe bookkeeping is tied to tax roles. However, true quality bookkeeping is a forward-looking accounting services-focused position, not an archival position. And for those who correlate bookkeepers with tax functions, bookkeepers are rarely even properly certified to prepare taxes or file them.

Get support

QuickBooks Live customers may cancel plans at any time. Cleanup typically takes 30 days once you upload your required docs. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

A controller reviews the bookkeeper’s ledger for accuracy while also maintaining the integrity of the accounting data file in the future so that adjustments can’t be made without approval. Lastly, a controller issues monthly financial reports highlighting any critical issues that you need to understand and possibly address. Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll.

Explore More about our Services.Talk to Us.

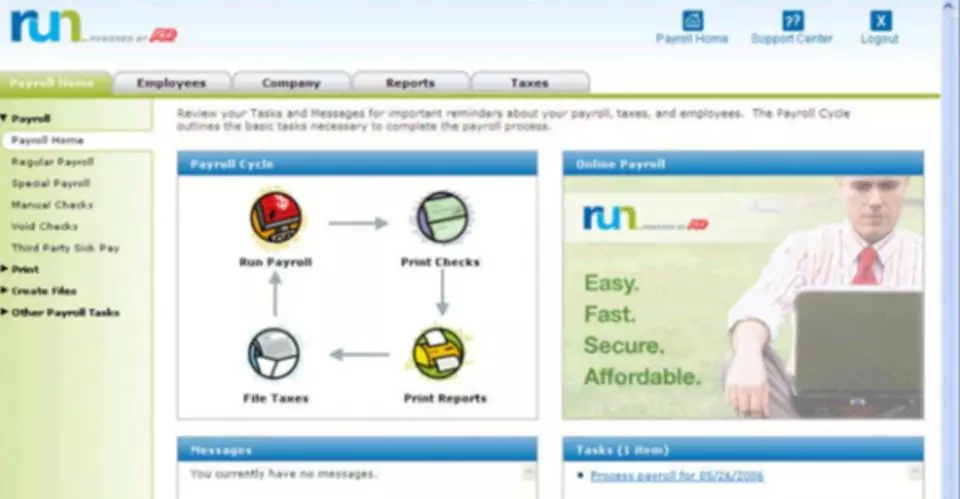

Tell us about your business and we’ll get back to you with a quote based on your requirements. Under one roof, with affordable fixed rate costs and a range of packages to suit different businesses. We are partner and expert with best payroll processing software.